Calculate my overtime pay

Calculate hourly and premium rates that could apply if you are paid overtime. How can I getting excel to calculate overtime in a template where the pay periods are first to the 15 and 16 through 31 st Reply.

Learn How To Calculate Overtime In Excel Excelchat

Calculate the overtime hourly rate.

. When you want to see how much overtime pay you will earn you can use this Overtime Calculator from the United States Department of Labor to help you determine if youre eligible for overtime pay and to calculate how much overtime you will receive for a typical. Create professional looking paystubs. You have already accounted for the overtime hours once in the regular hourly rate.

See 5 CFR part 551 subpart E Example. Overtime wages are a type of increased payment that employees can earn when they work more than a certain number of hours in a workday or workweek. Find out when the double-time pay rate applies.

Federal law view holidays as just another business day but both federal eg the FLSA and state laws require most employers but not all to. Calculate the overtime wages. The details about when overtime applies are different under each award and registered agreement.

How does it apply. 11 minutes Editors note. To determine your total overtime wages multiply the number of overtime hours by the.

10 x 05 5 more per overtime hour. Also the maximum biweekly or annual earnings limitations on title 5 premium pay do not apply to FLSA overtime pay. Calculate overtime pay for a monthly-rated employee If you are a monthly-rated employee covered under Part IV of the Employment Act use this calculator to find out your pay for working overtime.

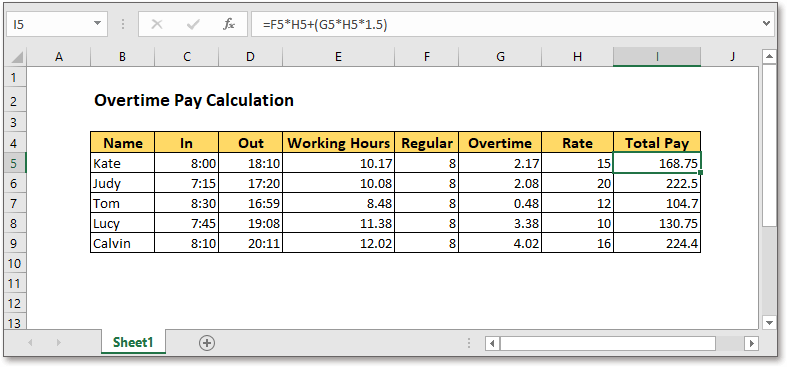

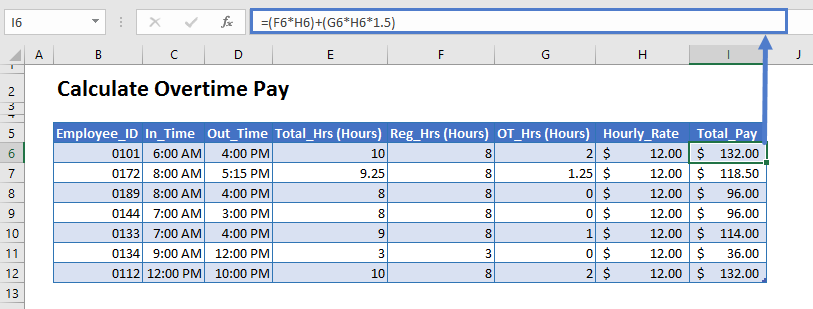

Ad In a few easy steps you can create your own paystubs and have them sent to your email. Here in this tutorial it shows a timesheet to list the working hours and provides a formula to calculate the overtime pay. Sébastien will receive 800 in regular pay plus 150 in overtime pay for a total of 950.

Figure out your hourly rate. A non-workman earning up to 2600. How does the employer calculate his overtime.

If you are paid on an hourly or daily basis the annual salary calculation does not apply to you. Overtime refers to the time worked by an employee over 40 hours per week. After reviewing the number of overtime hours you worked in a given week and your companys overtime pay rate you can calculate your overtime pay for a given period.

He worked 5 hours of overtime so 5 x 30 150. When you are done the system will automatically calculate for you the amount you are expected to pay for your order depending on the details you give such as subject area number of pages urgency and academic level. Calculate your overtime pay.

According to The Fair Labor Standards Act FLSA most employees must be paid 15 times their regular working wage for any work above 40 hours per week. The FLSA requires 10 minutes of rounding per shift for every employee. Input the Over Time Hourly Rate The.

Ad Explore Work Hours Calculator Tools Other Technology Users Swear By - Start Now. Per year that comes out to 21736 making Allen eligible for overtime pay. Because of this you will multiply the regular hourly rate by 05 instead of 15 to get the overtime hourly rate.

An exception means that overtime is paid to a certain classification of employees on a basis that differs from that. Input the Regular Hourly Rate Over Time. How can I calculate what my overtime pay should be.

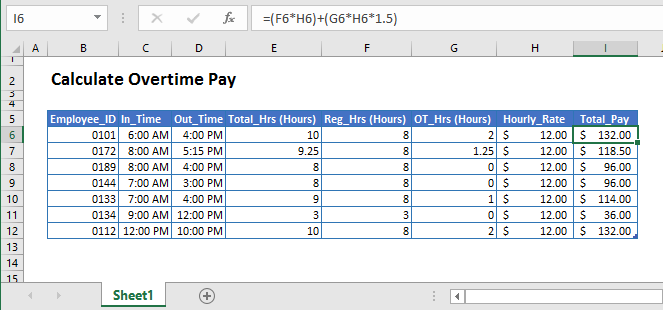

He is paid at time and a half 20 x 15 30 for each overtime hour. For detailed steps see Question 18 starting on page 1 of the instructions Calculate the gross average weekly wage by adding up the gross amounts paid and then divide by eight. How to Calculate Overtime Pay Heres information on how overtime pay is calculated.

15 Jobs That Are More Likely To Offer Overtime. Normal pay per day worked x 1 Ordinary Pay. The employer pays Sébastien his base wage of 20 x 40 hours 800.

Multiply the straight time rate of pay by all overtime hours worked PLUS one-half of the employees hourly regular rate of pay times all overtime hours worked. What is my regular rate of pay for purposes of the FFCRA. Protecting Workers Rights Nationwide.

There are also a number of exceptions to the general overtime law stated above. Normally Working Hour Rate is different from the Over Time Hourly Rate. There are no comments posted here yet.

If you have not worked for your current employer for six months the regular rate used to. Overtime Counted After. Non-Exempt Employees in Holiday Pay.

If your office maintains 45 or other working hours input that value in this field. An exemption means that the overtime law does not apply to a particular classification of employees. After filling out the order form you fill in the sign up details.

Ensure you request for assistant if you cant find the section. His regular rate is equal to 418 divided by 38 hours or 11 per hour. Generally this is 40 hours per week.

To find out when overtime applies in your industry see When overtime applies. In some cases however employers must use a formula to calculate weighted overtime. Must-know Malaysia Leave Types and Overtime Pay Rates is an article written by Nan An and further updated by Hern Yee from Talenox.

The Malaysian GDP grew at an average of 65 per annum for almost 50 years complemented by its amazing geographic location and multilingual mix of Malay Indian and. For purposes of the FFCRA the regular rate of pay used to calculate your paid leave is the average of your regular rate over a period of up to six months prior to the date on which you take leave. You can claim overtime if you are.

You can calculate your double-time by following these simple steps. Most nonexempt employees in California have a legal right to receive overtime wages when they work long hours1 The amount of overtime depends on the length of the employees shift and the number of days. How Leap Year Changes your Bi-Weekly Gross.

Before you can calculate your double-time pay you need to determine when you are eligible for it. If you have questions about your rights to overtime pay as a salaried employee call today to set up a free consultation. If you worked overtime for 53 minutes your employer can round it down to 50 minutes.

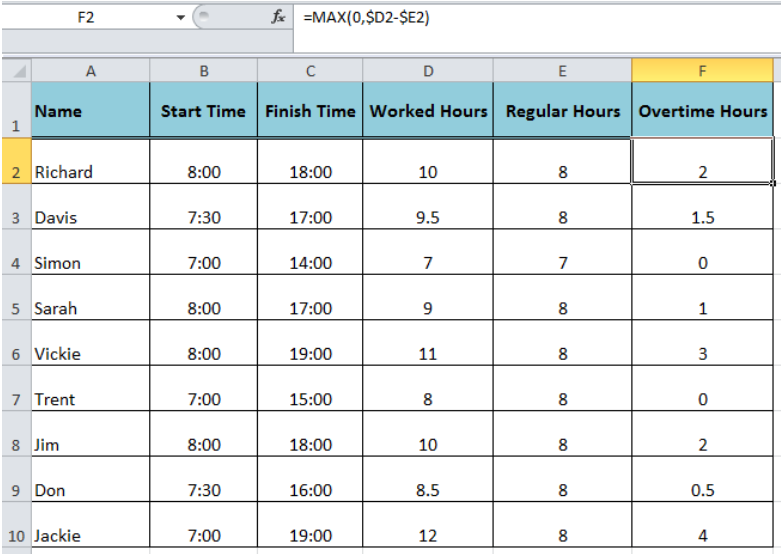

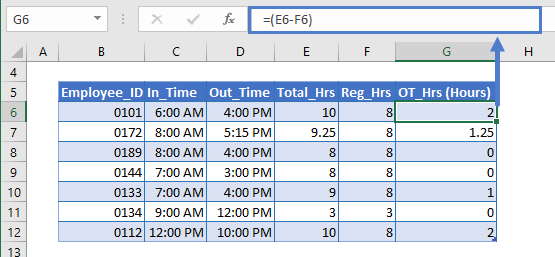

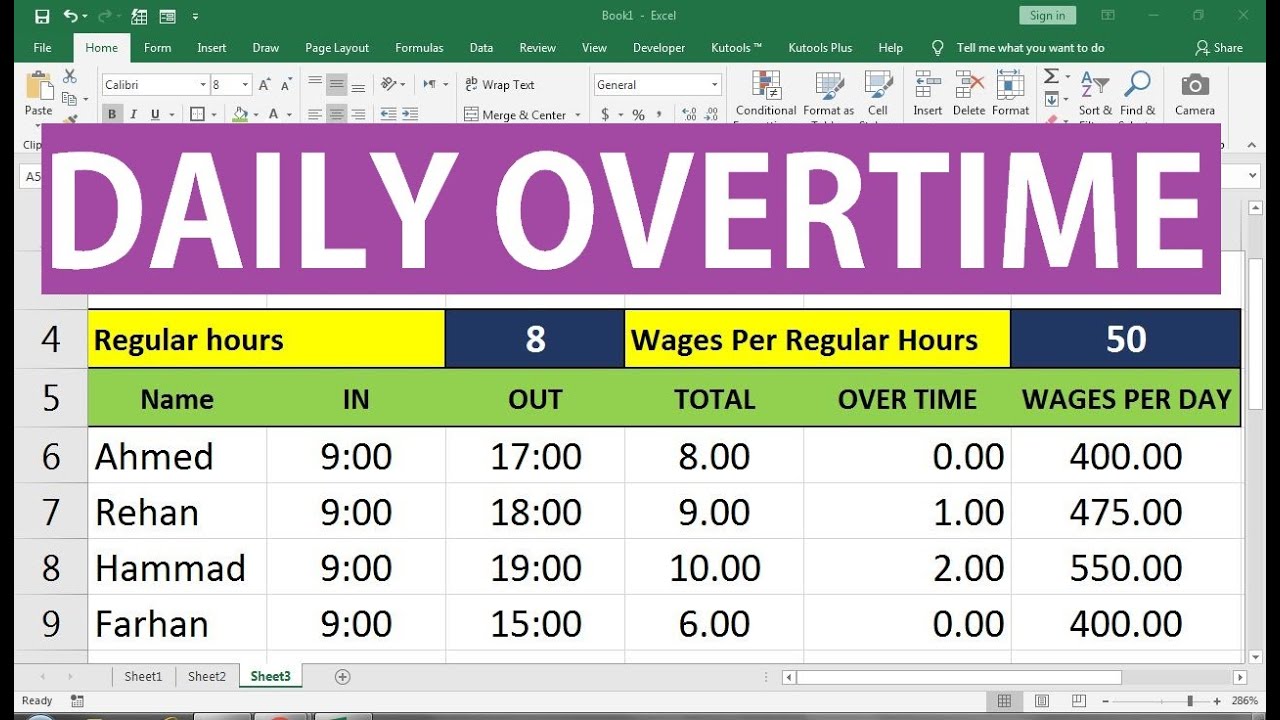

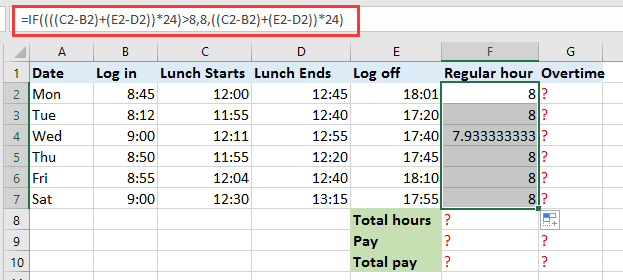

To calculate overtime rates use our Pay and Conditions Tool. Examine your union contract or employee handbook to learn more about the applicable overtime pay rates. To calculate the overtime hour and payment you can do as below.

For claim periods starting on or after 1 May 2021 when you calculate the average wages for employees on variable pay you should not include days during or wages related to a period of statutory. We use the most recent and accurate information. You can also find information about pay under your relevant award by visiting our Pay guides page.

Your bi-weekly pay is calculated by multiplying your daily or hourly rate times the number of days or hours you are paid. Pay including any overtime and tips earned for that week plus the weekly prorated amount of any bonus or commission received during the preceding 52 weeks. This means that companies can round down up to 7 minutes of overtime but they cannot round down 8-14 minutes of overtime.

Most workers in the United States are entitled to overtime pay which should kick in after you clock in more than 40 hours worked in a given weekSince the typical overtime wage rate is 15 times your regular rate of pay this premium pay requirement has been given the nickname time-and-a-half What Is Double Overtime. Generally overtime pay is different from the regular working pay for instance 10 dollars per hour for regular working hours but 15 dollars per hour for working overtime. According to his employment contract Allen is expected to work 38 hours every week.

Some employees however are entitled to more. Apply a formula to display the regular working hour first. There are however a number of exemptions from the overtime law.

Working hours vary from country to country. 8-14 minutes must count as a quarter hour of work.

Excel Formula Calculate Overtime Pay

Excel Formula Basic Overtime Calculation Formula

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Overtime Calculator To Calculate Time And A Half Rate And More

Calculate Overtime In Excel Google Sheets Automate Excel

Excel Formula Timesheet Overtime Calculation Formula Exceljet

Overtime Pay Calculators

Overtime Calculator

Calculate Overtime In Excel Google Sheets Automate Excel

How To Calculate Overtime Pay For Hourly And Salaried Employees Article

Overtime Calculation Formula In Excel Youtube

Overtime Pay Calculators

Overtime Pay Calculators

How To Quickly Calculate The Overtime And Payment In Excel

Calculate Overtime In Excel Google Sheets Automate Excel

How To Quickly Calculate The Overtime And Payment In Excel

How To Calculate Overtime Pay From For Salary Employees Youtube